Condition vs Rarity: 1922 Liberty Silver Dollar

The 1922 Liberty silver dollar represents a unique object for studying the "condition vs rarity" concept.

With a total mintage exceeding 84 million specimens, this coin remains the most common in its series.

High availability of coins in low and mid-range grades (up to MS63) makes them a mass-market commodity having a price correlating with silver spot rates.

The market situation changes radically upon transitioning to top-tier preservation categories where physical condition becomes the dominant rarity factor.

In numismatics, this phenomenon is called "condition rarity," occurring when the issue year itself is not rare, but specimens in perfect condition are practically non-existent.

Statistical analysis of population reports from grading agencies confirms a deficit of coins in MS67 grade and higher.

Sheldon Grade | Registry Quantity | Market Status |

VG8 - AU58 | Millions | Mass Mintage / Metal Price |

MS60 - MS63 | Hundreds of thousands | Accessible collectible material |

MS64 - MS65 | Tens of thousands | Investment level |

MS66 | Approximately 3,000 | High condition rarity |

MS67 | Fewer than 150 | Extreme condition rarity |

Correlation Between Mintage and Specimen Survival

The massive Philadelphia Mint mintage (51,737,000 pieces) creates a false impression regarding the low value of any 1922 dollar.

Minting technological conditions in the 1920s involved finished coins falling into general bins, causing the appearance of contact marks.

The process of transporting coins in bags of 1,000 pieces led to further deterioration of the surface condition.

As a result of these processes, 99.8% of the mintage received micro-scratches excluding the possibility of assigning grades higher than MS65.

The rarity of the 1922 dollar is not absolute, as seen in the 1928 issue, but is a derivative of minting and storage quality.

Investors analyzing the market focus on the percentage ratio of certified coins to the total mintage.

For the 1922 issue, the share of coins in MS67 grade represents less than 0.0003% of the total production volume.

Economic Gap Between Grades

Pricing of the 1922 dollar demonstrates a non-linear dependence on preservation.

The price difference between a coin in MS65 and MS67 condition can exceed 10,000%.

In 2021, a 1922 specimen in PCGS MS67 grade sold at auction for 41,125 USD.

Meanwhile, the market value of an analogous coin in MS65 grade averages 150 USD.

Reducing the grade by just two steps devalues the asset 274 times.

This statistical fact confirms the priority of condition over the nominal rarity of the issue year.

Auction Record Statistics

1922-P MS67: $41,125 (2021 Auction).

1922-D MS67: $20,400 (2019 Auction).

1922-S MS67: $28,800 (2022 Auction).

Influence of Characteristics on Grading

Evaluating the 1922 Peace Dollar preservation includes an analysis of detail sharpness, and luster intensity.

Transitioning to a low-relief die in 1922 resulted in many coins having an inherently weak strike (soft strike).

Weak detailing of Liberty's hair above the ear and the eagle's feathers on the reverse is often mistakenly interpreted as wear.

Grading experts distinguish technological "understriking" from physical abrasion occurring during circulation.

The presence of original mint luster is a critical condition for obtaining a Mint State grade.

Any attempt at cleaning the coin with abrasive substances irrevocably destroys the micro-relief, reducing the price to silver scrap levels.

Using a free coin identifier app allows for localizing small defects influencing the final score.

Regional Rarity: P, D, and S

Each of the three mints producing dollars in 1922 possesses its own preservation characteristics.

The Denver Mint (1922-D) is characterized by the highest quality execution, providing sharpness for all design elements.

Despite this, the number of 1922-D coins in MS67 grade remains extremely low — approximately 40 specimens in the PCGS registry.

San Francisco coins (1922-S) traditionally have the weakest luster and a surface susceptible to corrosion.

The numismatic premium for a 1922-S in MS66 grade is significantly higher than for a Philadelphia issue of the same grade.

This stems from the difficulty in finding a specimen in San Francisco with clean fields and an absence of cladding defects.

Market Dynamics and Investment Risks

Investing in high-preservation 1922 dollars requires an understanding of market cycles.

Over the last 15 years, the MS65 price demonstrated stability, increasing on average by 3% annually.

The MS67 segment is subject to high volatility depending on the appearance of new specimens in population reports.

The market entry of a single new certified MS67 specimen can reduce the price of existing lots by 10–15% due to supply expansion.

Investors prefer coins with additional quality attributes such as the CAC (Certified Acceptance Corp) sticker.

The presence of a CAC sticker increases the value of an MS66 coin by 20–30% relative to analogous coins without confirmation.

Errors vs Condition

For the 1922 issue, rarity can be determined not only by condition but also by minting defects.

The VAM-2L variety featuring a shifted image or large die cracks is valued higher than standard samples.

However, the presence of an error on a coin in poor condition does not create high added value.

The market prioritizes the combination of a rare variety and a high grade.

The price for a rare VAM in MS64 grade can be 5 times higher than the price of a standard 1922 coin in the same grade.

Statistics show that the number of professional VAM variety collectors grows by 4% annually.

Verification Rules and Counterfeit Protection

The high cost of rare 1922 dollar grades stimulates the appearance of high-quality counterfeits.

Fakes are often manufactured using laser scanning of original coins followed by striking.

The primary protection method involves utilizing services from authoritative grading companies.

A coin checker app certification guarantees metal authenticity, weight compliance (26.73 g), and the absence of restoration signs.

The percentage of counterfeit coins among uncertified "high-quality" lots on online platforms reaches 15%.

Studying the edge and luster micro-lines remains a fundamental skill for expert evaluation.

Price Forecast Through 2030

Historical data analysis allows for assumptions regarding future price dynamics.

Continued price growth for MS66 and MS67 specimens is expected due to the physical reduction of available material.

Coins in grades below MS64 will follow the silver price, showing returns at inflation levels.

Increased interest in the modern numismatic market from alternative investment funds may raise demand for top grades.

Statistics for 2020–2024 record a capital inflow into certified American dollars amounting to approximately 180 million USD annually.

The 1922 dollar will remain a key market indicator due to its high liquidity.

Value Factors

The value of the 1922 silver dollar is determined exclusively by its preservation grade, ignoring the total mintage.

Rarity in this case is artificial, created by strict grading standards and historical storage conditions.

For capital formation, acquiring coins in MS64–MS66 grades with confirmed certification is recommended.

Ignoring small defects at the purchase stage leads to a loss of liquidity during subsequent resale.

Market statistics confirm the advantage of "condition rarity" over "mintage rarity" for this historical period.

Thorough surface analysis and knowledge of auction trends remain the main tools for a professional market participant.

Read more

Unraveling Hidden Messages and Easter Eggs in Cartoon Conspiracy Theories

Cartoons have long been a source of entertainment and enjoyment for people of all ages. However, what if there was more to these animated shows than meets the eye? Many fans have speculated that there...

Animation in the Future: What's in Store for the Industry in the Coming Decade

Dive into the transformative trends shaping the animation industry over the next decade, from cutting-edge technological advancements like real-time animation and AI, to evolving storytelling with inc...

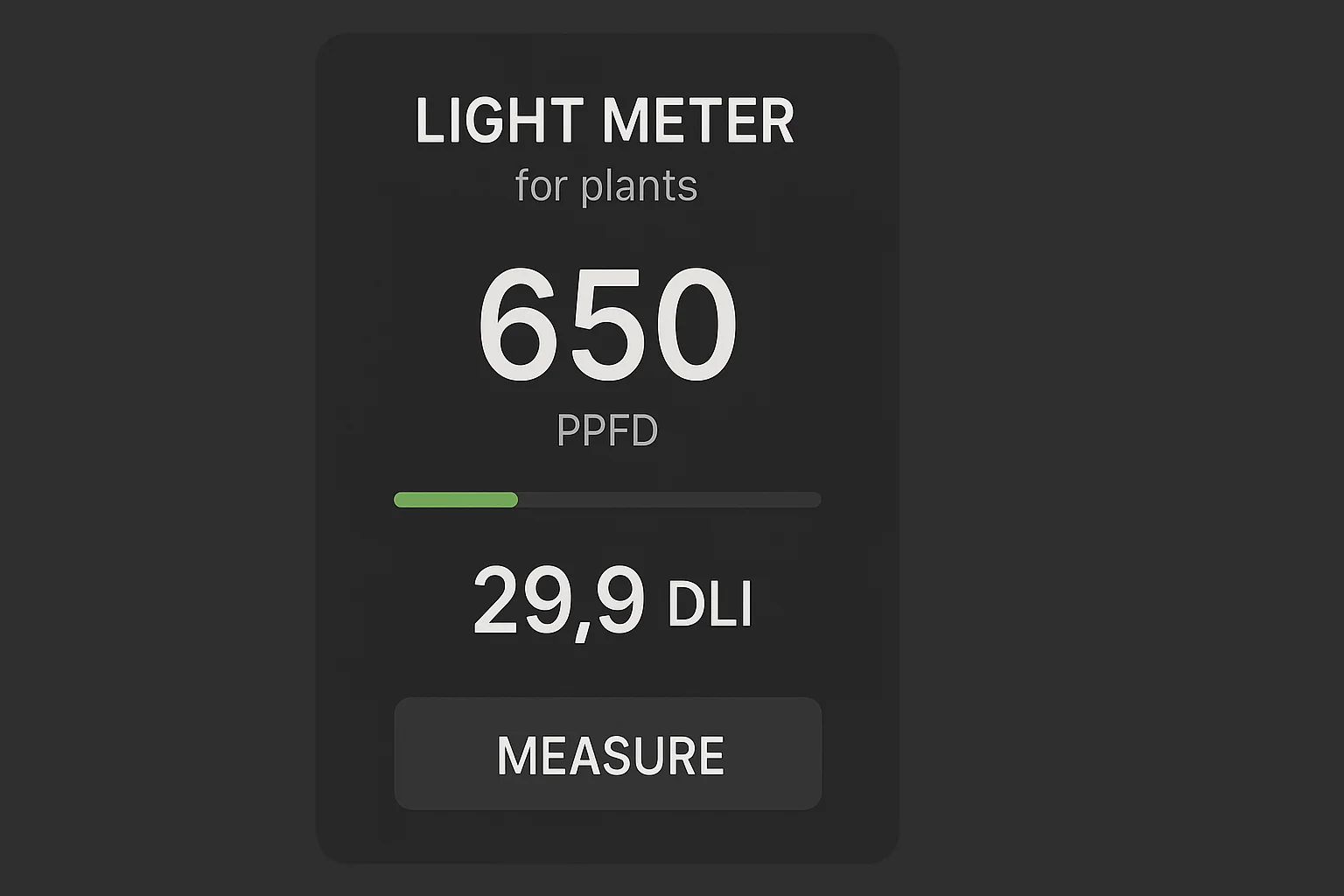

How to Measure Light for Plants: Apps, Lux Meters, and PAR Devices

Explore the best light meters for plants, including AI Plant Finder, lux meters, and PAR devices. Learn how each option helps match light levels to plant needs for healthier growth....